Gross Margin is the revenue left over after subtracting the cost of goods sold. Expressed as a percentage of total revenue, the amount of money you have to pay operating expenses and reinvest back into the business.

Keeping an eye on your gross margin is critical for startups. Having a high gross margin means you’ll be able to grow faster because you have more money leftover to spend on growing the business.

In this blog, we cover how to calculate gross margin, what a “good” gross margin is, how to improve your gross margin, and more.

How do you calculate gross margin?

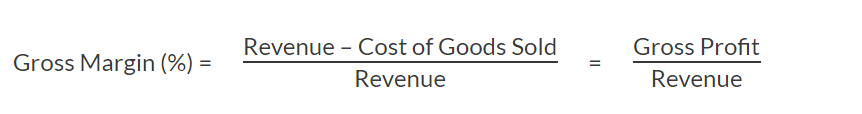

To calculate your gross margin, you need to first find your cost of goods sold (COGS). COGS includes any expenses necessary to provide your service or product to your customers (ie. hosting, support costs, third party integration fees). You can learn more about calculating COGS in this Academy article.

Once you know the monthly cost of goods sold, divide the difference between COGS and MRR by revenue to find your gross margin.

For example, if you sold $10 pens that cost $3 to make, package and ship, your gross margin on each pen is 70%.

Gross Margin = ($10-$3)/$10 = 70%

What is the difference between gross margin and net margin?

Gross margin measures the percentage of revenue that remains after deducting the cost of goods sold (COGS), while net margin measures the percentage of revenue that remains after all expenses, including operating expenses and taxes, have been deducted.

Net margin, on the other hand is a more comprehensive measure of profitability, as it takes into account all expenses, while gross margin only considers COGS.

What’s a “good” gross margin for a SaaS company?

It’s basic math – if you want to make money, you need to sell your products for more than they cost to make. The more profit you make on each item, the better.

Generally, you want to increase your gross margin as you grow. A higher gross margin means each $1 of revenue is more valuable to your business.

Compare Company A with a 10% gross margin to their competitor Company B with an 80% gross margin. Company A will be able to reinvest 10 cents of every dollar of sales back into the company. Company B will have 80 cents on the dollar.

That’s a huge advantage when it comes to marketing or R&D spending. It’s a big reason why a company with $10 million in revenue might be worth more than a company with $20 million in revenue.

What are some benchmarks for SaaS gross margins?

Industry research indicates that the median gross margin for SaaS companies is around 73%, although this figure can vary significantly depending on the nature of the business. As an example, enterprise SaaS companies tend to have higher gross margins compared to non-enterprise companies.

Most VCs and SaaS experts suggest SaaS companies aim for a gross margin of around 80%.

Suggested Gross Margin Targets

- John Greathouse, GoToMeeting – over 80%

- Jason Lemkin, SaaStr – over 80%

- David Cummings, Pardot – 70-80%

- Tom Tunguz, VC Redpoint – 50 – 75% depending on lifecycle stage

How can a SaaS company improve its gross margin?

To improve gross margin, you have two options: increase revenue or decrease COGS.

When you’re just starting out, your gross margin is likely to be lower because you’re not benefitting from economies of scale. As you acquire more customers, it becomes cheaper to support each one. As a result, your COGS decreases and your gross margin increases.

It can be tempting to continue cutting costs and increasing prices to grow your gross margin. But it’s a balancing act. Too little quality or a too expensive product might mean too few customers. A 50% gross margin on $1000 of revenue is still better than a 90% gross margin on $500 of revenue.

FAQ's

-

How do you calculate gross margin?

Gross margin is calculated by subtracting the cost of goods sold (COGS) from total revenue and dividing the result by total revenue. The formula for gross margin is: Gross Margin = (Total Revenue - COGS) / Total Revenue. This yields a percentage that represents the portion of revenue that remains after accounting for the costs of producing or delivering the product or service. -

What are some benchmarks for SaaS gross margins?

According to industry research, the median gross margin for SaaS companies is around 73%, but this can vary widely depending on the type of business. For example, enterprise SaaS companies often have higher gross margins than consumer-focused SaaS businesses. Benchmarking against peers in the same industry can help companies evaluate their own gross margin performance. -

How can a SaaS company improve its gross margin?

There are several strategies that SaaS companies can use to improve their gross margin, including optimizing pricing and packaging, reducing customer acquisition costs, increasing upsells and cross-sells, and improving operational efficiency. Investing in product development and innovation can also help SaaS companies differentiate themselves from competitors and command higher prices, which can boost gross margin over time. -

What is the difference between gross margin and net margin?

Gross margin measures the percentage of revenue that remains after deducting the cost of goods sold (COGS), while net margin measures the percentage of revenue that remains after all expenses, including operating expenses and taxes, have been deducted. Net margin is a more comprehensive measure of profitability, as it takes into account all expenses, while gross margin only considers COGS. -

What is an example of a good gross margin?

Good gross margin varies from industry to industry. Retail considers a good profit margin to be around 50%, while tech and finance aim higher, for roughly 80%.